Navigating the Fog: Current U.S. Real Estate Market Context

A five-minute executive brief for HNWIs, Family Offices, and RIAs—why Senior Housing is emerging as essential, income-durable infrastructure amid macro uncertainty.

I. Macroeconomic Headwinds & Investor Sentiment

The market is operating in “the fog”—heightened uncertainty with ongoing desire to transact. The three dominant variables are interest rates, job/income growth, and inflation. Policy adds crosscurrents: immigration tightens labor supply and elevates costs; tariffs raise intermediate and final goods prices, lifting construction and OpEx.

- Buy-side optimism: The “buy” barometer is at a 20-year high among industry leaders.

- Costs dominate: Labor, regulatory, operating, and weather risks compress margins—demanding operational excellence.

“It is a curious time for real estate with lots of uncertainty—and a desire to do deals.”

PwC & ULI, Emerging Trends in Real Estate® 2026II. The Rise of Essential Real Estate (Niche → Core)

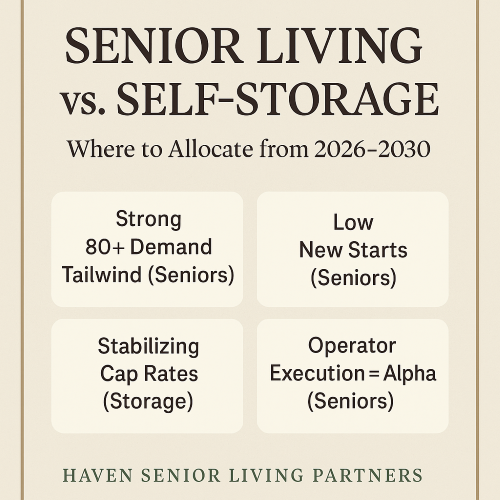

Former “niche” sectors now sit at the core of allocation: Data Centers, Senior Housing, Self-Storage, and Medical Office. The common thread is essential services and durable, cycle-resilient demand.

- Data Centers: #1 for investment & development; AI/cloud demand vs. power & water constraints.

- Self-Storage: Rapid ascent; complements residential exposure—“5th property type.”

- MOB: Long leases with contractual bumps; broad geographic targets.

- Senior Housing: Newly mainstream, now a major property-type category.

III. Senior Housing: Demographics & Fundamentals

Irreversible Demand Drivers

- Boomers turn 80 in 2026 → inflection in care and community demand.

- 75+ cohort +4M by 2030 → accelerating move from owned homes to rentals & group settings.

- Homeownership falls from ~75% (age 75) to ~53% (age 90) → sustained absorption.

Supply Tightness & Occupancy

- Inventory growth ~1% (cycle low since 2006); in several markets, more units come offline than deliver.

- Occupancy tracking toward 90%+ in 2026—potential 20-year high.

- 2027+: National shortage risk as demand > new supply.

IV. 2026 Comparative Outlook by Property Type

| Property Type | 2026 Rank | Rationale / Highlights |

|---|---|---|

| Data Centers | #1 | AI/cloud demand; infrastructure-like; risks around power/water access and leasing concentration. |

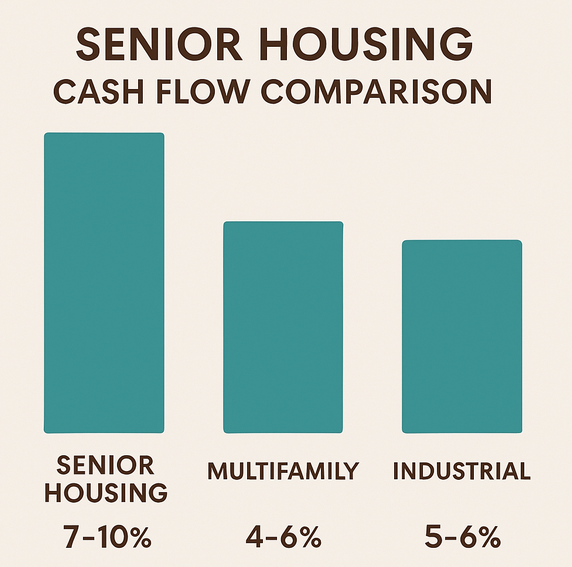

| Senior Housing | #2 | Demographic inevitability, tight supply, rising occupancy; strongest YoY transaction growth in early 2025. |

| Medical Office (MOB) | #3 | Durable, long-term leases with bumps; outpatient shift; broadable geographies. |

| Multifamily | Mid-High | Stability favored; headwinds where supply bulges (some Sun Belt); workforce/SFR resilient. |

| Industrial | Mid | Anchored in domestic consumption; construction costs and power access lengthen timelines. |

| Office | Lowest | Bifurcation persists; trophy assets strong, broad vacancies elevated; distress-led opportunities. |

Why Senior Housing now? Durable need, structural scarcity, and faster rent-reset cadence create an inflation-aware income profile with social impact.

V. Strategy for 2026: Back to Basics, Micro-Driven

- Granular underwriting: Submarket → microlocation → “street-corner” fit.

- Operational excellence: Asset quality, efficiency, climate resilience, tech readiness.

- Balance sheet savvy: Lock costs early; scenario-test insurance, utilities, and wage pressures.

“Strategy is shifting from macro-driven to micro-driven—specific asset, location, or street corner.”

PwC & ULI, Emerging Trends 2026Sources

Primary: PwC & Urban Land Institute, Emerging Trends in Real Estate® 2026 – United States & Canada, Nov 2025. Key references: “Navigating the Fog”, “Half Full or Half Empty? Capital Markets in the Fog”, “Niche to Essential Real Estate”, “Demographics Will Define Demand”, and “Property Type Outlook”.