For millions of Americans, retirement savings are deeply tied to the stock market, with the promise of growth overshadowed by market volatility. As of 2023, U.S. households collectively held over $33 trillion in retirement accounts, with a substantial portion invested in stocks and mutual funds. While these options dominate, few people are aware of a powerful alternative: self-directed IRAs (SDIRAs).

The Stock Market Dilemma

The stock market’s historical average annual return of 7-10% after inflation may sound appealing, but the journey is fraught with risks. Market downturns like the 2008 financial crisis and the 2020 COVID-19 crash wiped out trillions in retirement savings. A 2022 report from the Investment Company Institute revealed that 60% of IRA assets were invested in equities—a reflection of how limited many investors feel in their options.

The Opportunity with Self-Directed IRAs

Enter self-directed IRAs, which allow investors to diversify their portfolios beyond traditional assets. According to a 2023 study by the Retirement Industry Trust Association (RITA), only about 3% of U.S. retirement accounts are self-directed. This statistic underscores a massive untapped potential for education and awareness.

SDIRAs enable individuals to invest in:

1. Real estate: Residential, commercial, or senior living properties.

2. Private equity: Small businesses or startups.

3. Precious metals: Gold and silver.

4. Other alternative assets: Farmland, cryptocurrencies, or tax liens.

Why Real Estate, and Specifically Senior Living?

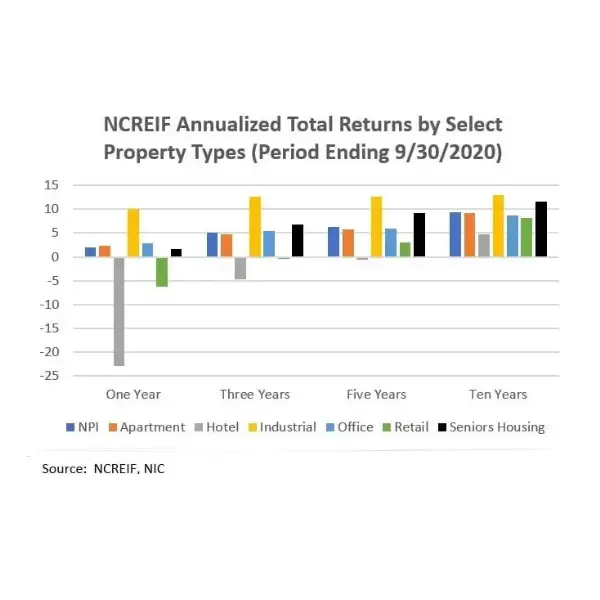

Real estate remains one of the most reliable investment classes, with an average annual return of 10.6% since 2000, according to the National Council of Real Estate Investment Fiduciaries (NCREIF). Even more compelling is the senior living sector, which has proven to be recession-resistant due to growing demand from an aging population.

Key Statistics:

Senior Housing Occupancy Rates: In Q3 2024, the National Investment Center for Seniors Housing & Care (NIC) reported occupancy rates rebounding to 83%, with steady growth projected.

Aging Population Growth: The U.S. Census Bureau estimates that by 2030, over 20% of the population will be 65 or older, fueling demand for senior living facilities.

Returns: The average annual return on senior living real estate investments ranges from 8-12%, often outpacing traditional equities.

Benefits of Senior Living Real Estate Investments

Stability: Unlike stocks, senior living investments are less correlated with economic downturns.

Passive Income: Investors can earn regular cash flow without the responsibilities of direct property management.

High Yield: Higher-than-average returns compared to traditional Wall Street investments.

Becoming the Guide for Alternative Investments

Investors may feel overwhelmed by the idea of branching out, which is where financial guides play a crucial role. By educating you about SDIRAs and alternative options like senior living real estate, we will:

- Help reduce their exposure to stock market volatility.

- Empower you to build diversified, resilient portfolios.

- Foster trust by being though of as a thought leader in the senior living investment space.

Conclusion: The Future of Investing

Heading into 2025, the need for financial diversification has never been greater. By leveraging the power of self-directed IRAs, investors can unlock opportunities in stable, high-yielding alternative assets. As a guide, we would like to have the chance to illuminate these pathways, creating value not just for yourself but for countless individuals seeking safer, smarter ways to grow their retirement savings.