Investment Opportunities

How it works

Investment Process

Launching Soon

Senior Housing Transformational Opportunity Zone Fund

A unique investment vehicle designed to deliver long-term tax advantages and powerful impact through purpose-built senior living communities in Qualified Opportunity Zones.

For accredited investors only. Limited allocations available.

General solicitation pursuant to Rule 506(c). Accredited investors only. Target projections; not guarantees. Past performance is not indicative of future results. See PPM for full risks and fees.

What is an Opportunity Zone Fund?

It’s an investment vehicle that lets you reinvest your capital gains into communities designated as Opportunity Zones. By doing so, you can defer today’s taxes, reduce them, and potentially eliminate taxes on all future appreciation if you hold your investment for 10+ years.

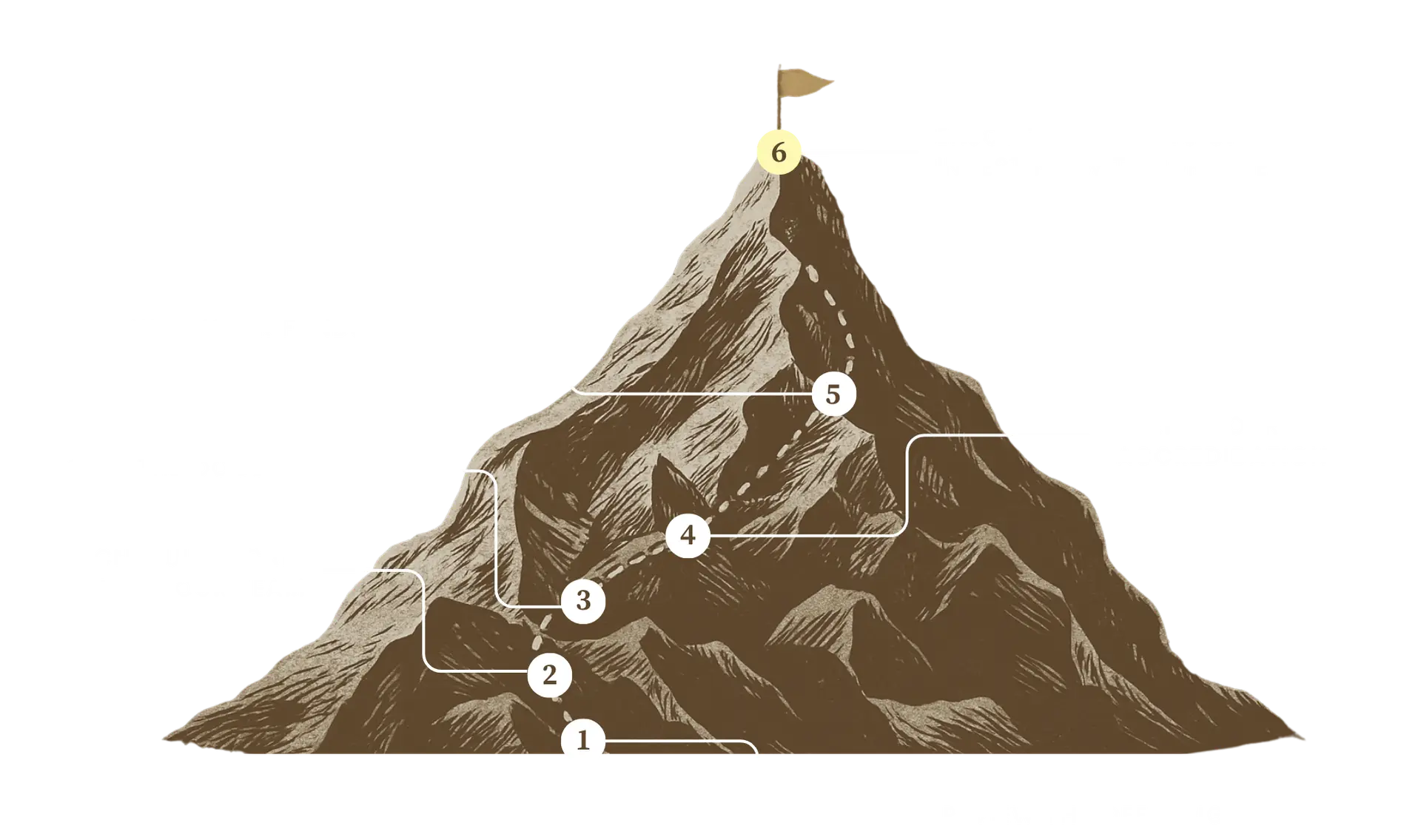

Form the Fund

We create a legal entity (usually an LLC taxed as a partnership) and register it with the IRS as a Qualified Opportunity Fund by filing IRS Form 8996.

Raise Capital

The fund is designed for investors with recent capital gains. If you roll those gains into the fund within 180 days, you can defer tax until December 31, 2026 (or until you sell your interest).

Deploy into Opportunity Zones

The fund must invest at least 90% of assets in qualified projects or businesses in designated OZs. This typically includes:

Developing or substantially improving real estate, or investing in operating businesses that are based in an Opportunity Zone.

Stay Compliant

We run semi-annual 90% asset tests, maintain detailed records, and file annual reports with the IRS. You’ll receive K-1s for your tax filings.

Enjoy the Tax Benefits

Immediate: Defer tax on your original gain until 2026.

Long-term: Hold 10+ years to eliminate capital gains tax on appreciation generated by the fund.

Exit Strategy

The fund is structured with a 10–12 year horizon. At exit, we sell projects or businesses and distribute proceeds — with tax-free appreciation for qualifying investors.

Frequently Asked Questions

What is senior housing investing?

Senior housing investing involves acquiring, developing, or funding residential communities that serve older adults—such as assisted living, memory care, and independent living—with the goal of generating stable, long-term returns.

Why is senior housing considered recession-resistant?

Because it's driven by demographic need—not economic cycles. Aging baby boomers and a growing 80+ population ensure steady demand, regardless of market volatility.

What types of senior housing are available to invest in?

Common asset types include Active Adult, Independent Living, Assisted Living, Memory Care, and Skilled Nursing. We focus on Independent Living, Assisted Living, and Memory Care due to their demand.

Who can invest in your offerings?

We partner with accredited investors, including HNWIs, family offices, RIAs, and institutional capital. Minimums vary by opportunity but typically start at $100,000.

How do I get updates on active deals?

You can subscribe to our investor newsletter or request access to our investor portal, where all new offerings, webinars, and reports are published first.

How is senior housing different from multifamily or industrial real estate?

Senior housing includes operational components (care staff, licensing, meals) and demographic demand that make it distinct. Returns are often higher, but underwriting requires sector-specific experience.

Is this a passive investment?

Yes. Investors participate as Limited Partners (LPs) in syndicated offerings with regular distributions, while Haven Senior Living Partners oversees operations and asset management.