You’ve mastered your profession. Now it’s time to master your wealth.

For decades, the American Dream has followed a familiar script: earn a degree, land a stable W-2 job, contribute to your 401(k), and hope retirement at 65 gives you the freedom you've worked for.

Your paycheck won’t make you wealthy.

The W-2 Trap

- Tax Burden: W-2 income is taxed at the highest rates, with limited deductions.

- Lifestyle Inflation: Bigger checks tend to fuel bigger spending.

- Time Poverty: You’re trading hours for income — and there are only so many hours in a day.

Eventually, the realization sets in: working harder doesn’t mean getting ahead.

The Shift: From Earned Income to Investment Income

The wealthy don’t rely solely on earned income — they own assets that generate income and appreciate in value.

"I work for income" → "I use income to buy freedom."

3 Steps to Escape the W-2 Wealth Ceiling

1. Pay Yourself First — But With Purpose

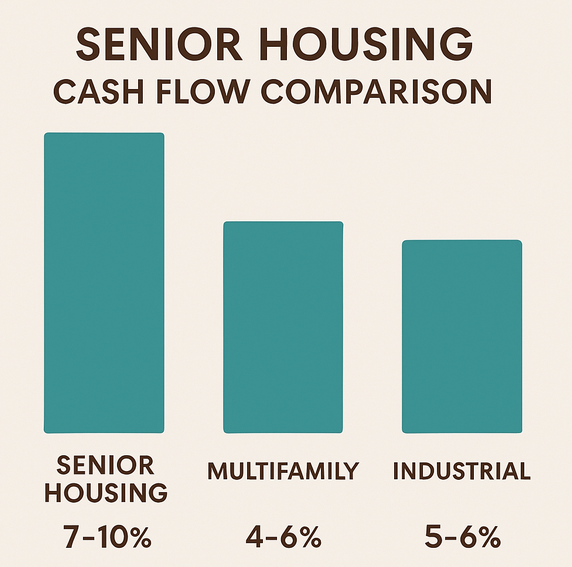

Instead of maxing out a 401(k), redirect part of your income toward alternative investments like real estate. These offer:

- Tax-advantaged income

- Predictable cash flow

- Tangible control

2. Turn Taxes Into Tailwinds

W-2 income is taxed heavily. Strategic investments unlock:

- Depreciation and cost segregation

- Bonus depreciation and 1031 exchanges

- Tax-deferred growth

3. Invest in What You Understand

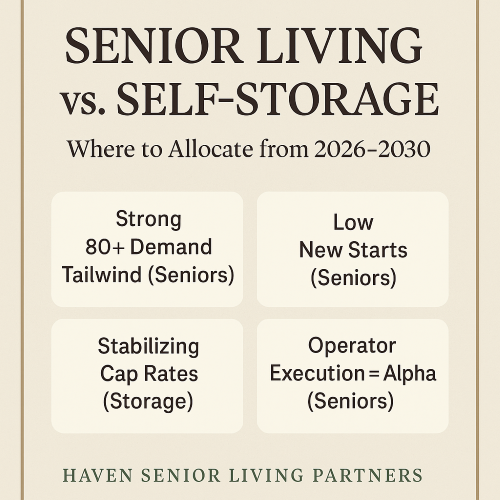

Don’t chase complexity. Find a niche like multifamily, self-storage, or senior living and go deep. The goal isn’t just diversification — it’s intelligent concentration.

Why Senior Housing Deserves a Look

With 10,000 Americans turning 65 every day, demand for senior living is exploding. For investors, this offers:

- Recession-resilient income

- Tax-advantaged growth

- Social impact tied to demographic certainty

Final Thought: You Don’t Have to Quit Your Job to Build Wealth

This isn't about abandoning your career — it's about reclaiming your options.

The goal isn’t early retirement. It’s early freedom.